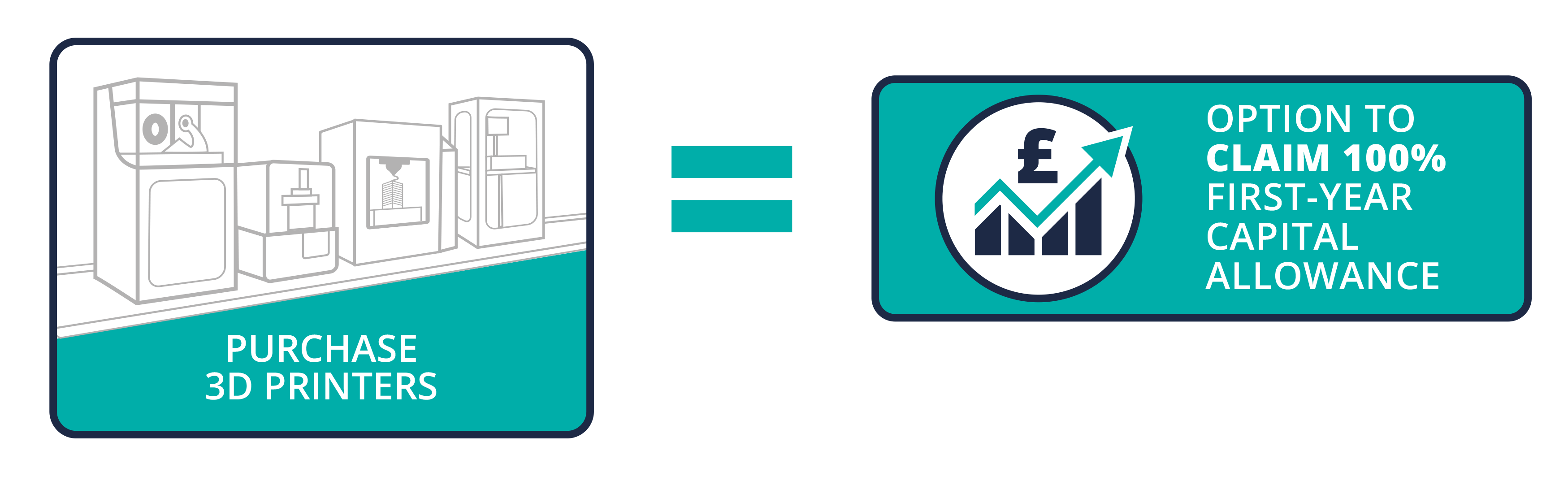

Full Expensing - Capital Allowance SchemeWRITE-OFF YOUR INVESTMENT IN ADDITIVE MANUFACTURING EQUIPMENT IN ONE GOThe Full Expensing Capital Allowance Scheme replaces the previous Super Deduction Scheme (ended Mar 2023). Now is the best time to invest in Additive Manufacturing equipment, with the use of the Full Expensing - Capital Allowance Scheme by the UK Government. From 01 April 2023, UK businesses can benefit from writing off the cost of investment in Additive equipment in one go*.

TAKE ADVANTAGE TODAY Give the team a call on 0800 689 1011 to discuss your requirements, or send us your require via the buttons below

Full expensing – offers 100% first-year relief to companies on qualifying new main rate 50% first-year allowance (FYA) for expenditure by companies on new special rate (including long life) assets Annual Investment Allowance (AIA) providing 100% first-year relief for plant and machinery investments up to £1 million, which is available for all businesses including unincorporated businesses and most partnerships

Worth noting...

|